flow through entity canada

The information in this section also applies if for the 1994 tax year you filed Form T664 Election to Report a Capital Gain on Property Owned at the End. However for US tax purposes ULCs may be treated either as partnerships or check-the-box flow-through entities possibly offering cross-border opportunities.

Why Do Llcs Result In Double Taxation For Canadians Madan Ca

A flow-through entity is a legal entity where income flows through to investors or owners.

. If you make a withholdable payment to a flow-through entity that is not one of the types described above you must treat the partner beneficiary or owner as applicable of the flow-through entity as the payee for Chapter 4 purposes similar to the determination of the payee for Chapter 3 purposes looking through partners beneficiaries and owners that are themselves flow. Flow-through entities include sole proprietorships partnerships limited liability partnerships LLCs and S corporations. The information in this section also applies if for the 1994 tax year you filed Form T664 Election to.

What is a flow-through limited partnership. For Canadian income tax purposes ULCs are considered corporations and are subject to Canadian income taxation. Relevance arose from the confluence of two factors.

Common types of FTEs are general partnerships limited partnerships and limited liability partnerships. Looking back mining executives lawyers bankers and accountants believe this. A flow-through limited partnership is an equity investment in a portfolio of flow-through shares of Canadian resource companies that combines unique tax advantages with the prospect for capital appreciation.

That is the income of the entity is treated as the income of the investors or owners. For Canadian income tax purposes ULCs are treated as regular corporations subject to Canadian tax on their worldwide income. In Canada however investment corporations whether mortgage trust mutual fund or partnership are regarded as flow-through entities.

For more information concerning the processing of the forms you may contact the Business Returns DivisionCall 1-855-432-5517. However for US tax purposes ULCs may be considered flow-through entities ie the ULC is disregarded and the earnings of the ULC are flowed through to the ultimate owners of the ULC. Flow-through shares are a financing tool available to a Canadian resource company that allows it to issue new equity shares to investors at a higher price than it would receive for normal shares thereby assisting it in raising money for exploration and development.

The flow-through share entered the Canadian tax code just over 25 years ago. Downsides to Flow-Through Entities There is a criticism on the flow-through entity this resulted from one of its drawbacks in which owners of entities are taxed on the income not directly receive by them but by the entity. Flow-through shares have generated billions for mining exploration and contributed to the development of some of the countrys most notable mines.

Due to the ease of. A pass-through entity also called a flow-through entity is a type of business structure used to. Canadas quirky tax innovation.

Flow through entity canada. Flow-through entities are also known as pass-through entities or fiscally-transparent entities. In Canada however investment corporations whether mortgage trust mutual fund or partnership are regarded as flow-through entities.

This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. Early-stage oil and gas or mining exploration companies receive special tax deductions that flow. In the United States certain business entities such as Limited Liability Companies LLC or subchapter S corporations are flow through entities where the entity does not pay tax but where the net income and other tax results flow through to the members or shareholders on a pro rata basis.

Flow Through Entities Owned by Residents of Canada.

Why Do Llcs Result In Double Taxation For Canadians Madan Ca

Profile Of Canada S Manufacturing Sector Bdc Ca Bdc Ca

Elective Pass Through Entity Tax Wolters Kluwer

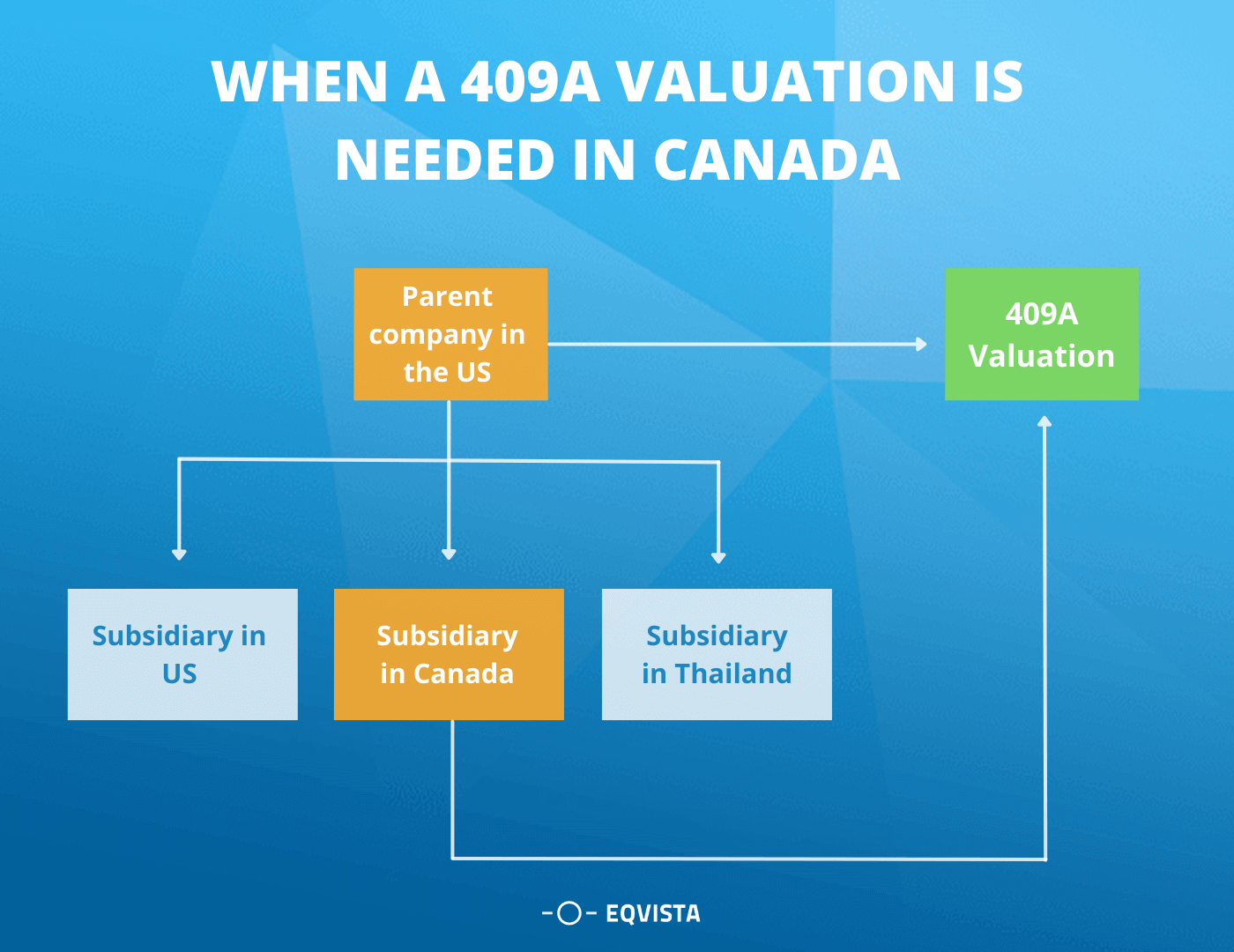

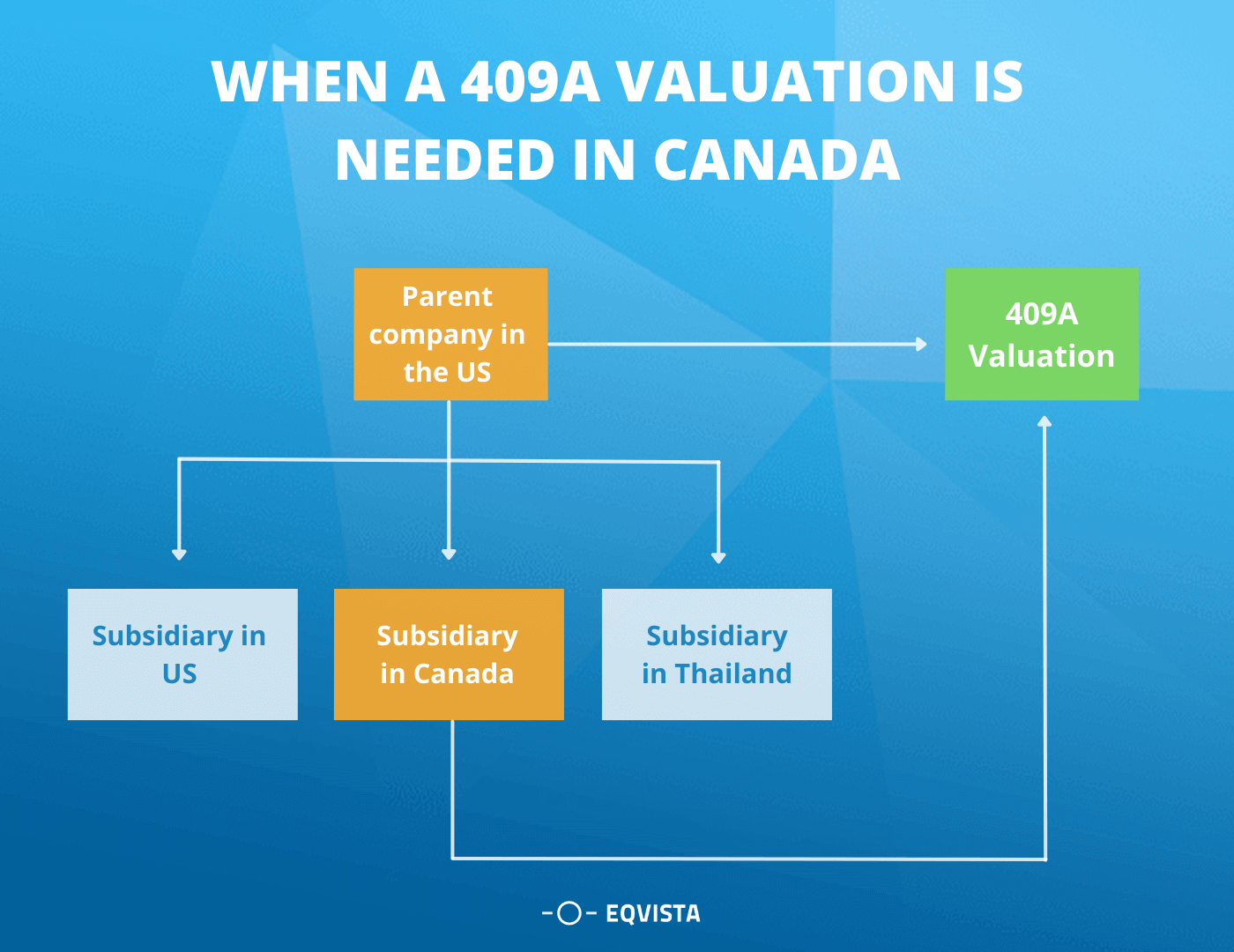

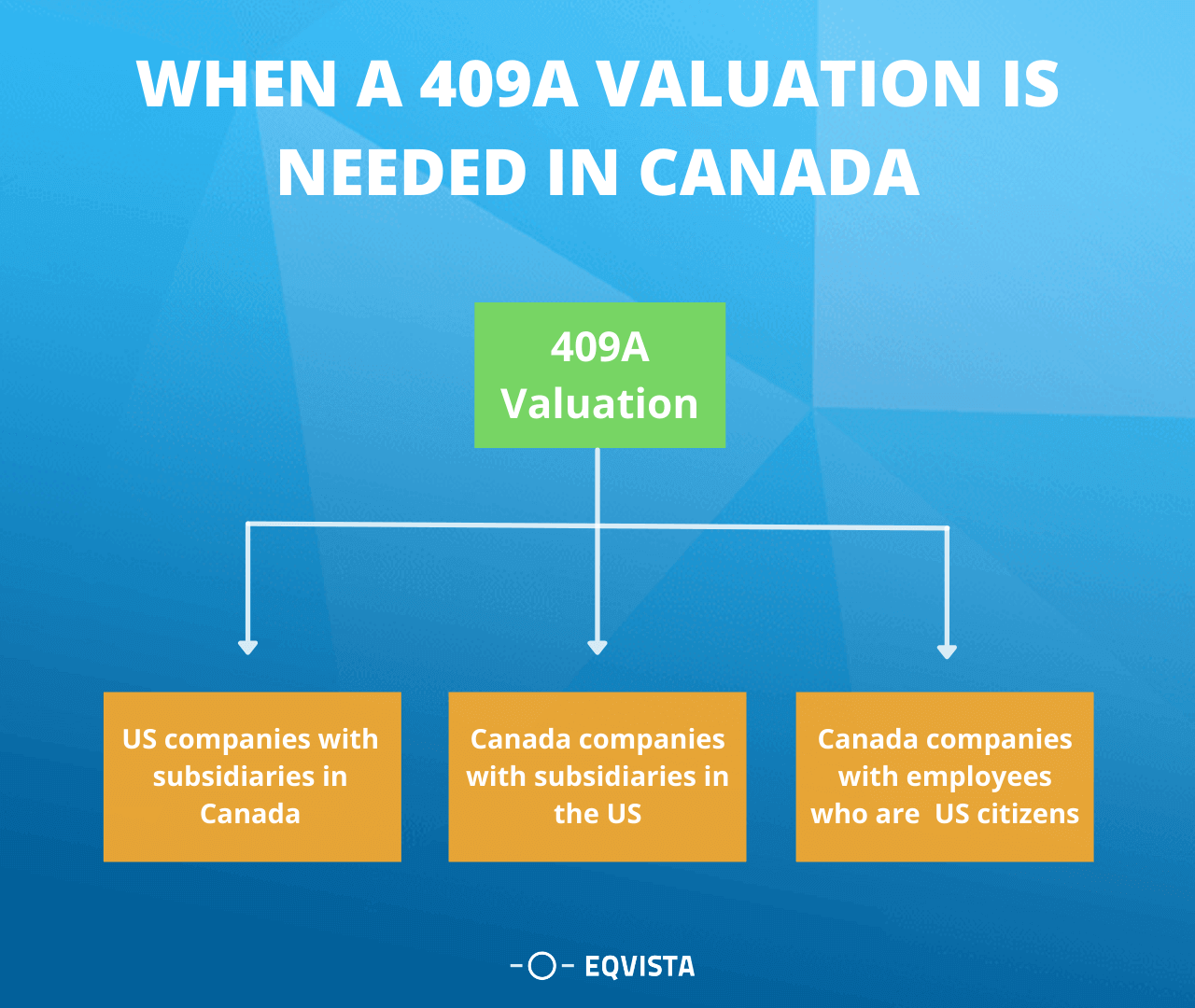

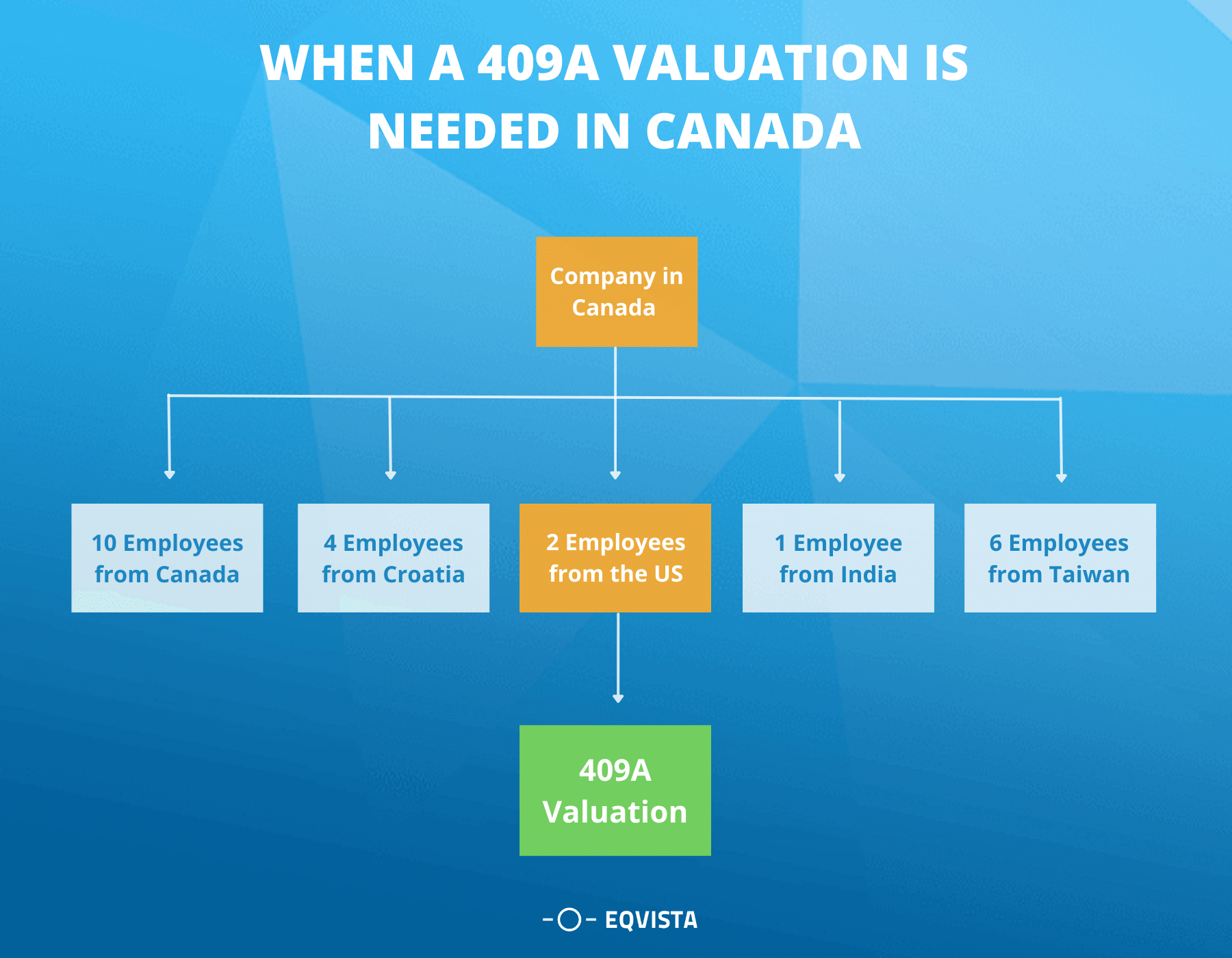

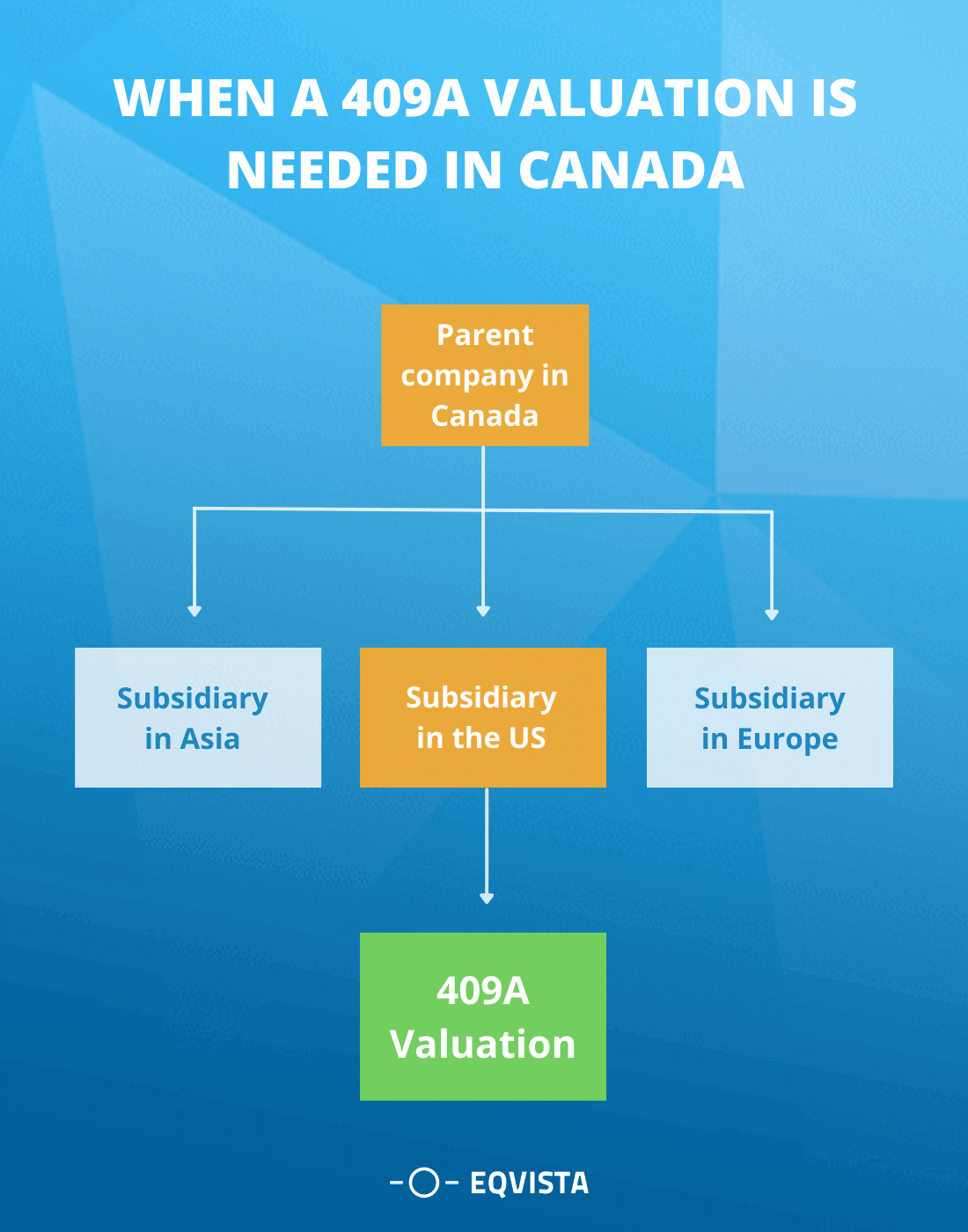

409a Valuation In Canada Eqvista

S Corporations In Canada Madan Ca

409a Valuation In Canada Eqvista

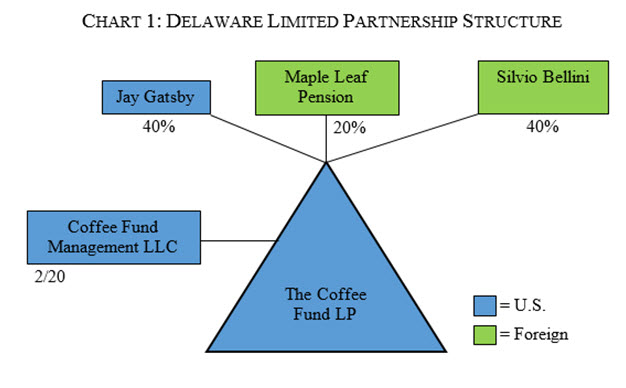

Structuring A U S Real Estate Fund A How To Guide For Emerging Managers Insights Venable Llp

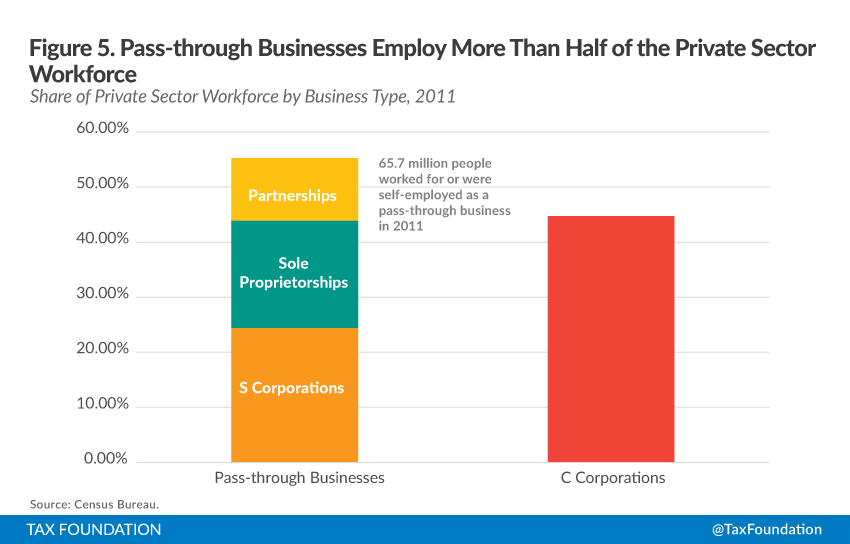

An Overview Of Pass Through Businesses In The United States Tax Foundation

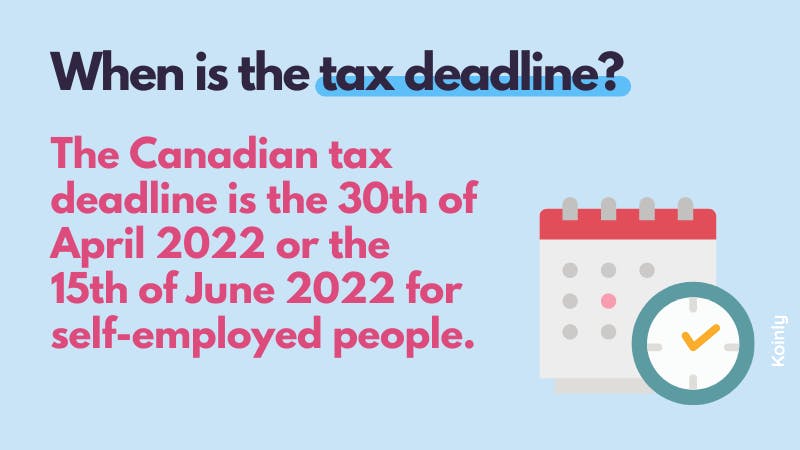

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Purchase Price Allocation Ppa Deloitte Netherlands

409a Valuation In Canada Eqvista

409a Valuation In Canada Eqvista

An Overview Of Pass Through Businesses In The United States Tax Foundation

Limited Liability Partnership Llp Partnership Structure Kalfa Law

Canada Crypto Tax The Ultimate 2022 Guide Koinly